Iwata’s full comments on NX, what Nintendo isn’t showing at E3 2015

Posted on 8 years ago by Brian(@NE_Brian) in 3DS, General Nintendo, News, Switch, Wii U | 20 Comments

Unofficial translations came up over the past few days regarding what Nintendo has in store for its new system codenamed “NX”. Nintendo has now put up a translation of its own, which has a slightly fuller response.

Of course, CEO Satoru Iwata made sure to withhold major information, but he did say that it’s not intended to be “a simple ‘replacement’ for Nintendo 3DS or Wii U.” Nintendo is also “taking into consideration various factors, including the playing environments that differ by country.”

Head past the break for Iwata’s full comments on NX, plus what Nintendo won’t be showing at E3 (posted on the site previously).

More: Satoru Iwata, top

Iwata on how Nintendo chooses partners, more on the Universal deal

Posted on 8 years ago by Brian(@NE_Brian) in General Nintendo, News | 0 comments

Over the past few months, Nintendo has announced a couple of key partnerships. The company has teamed up with DeNA for smart device games and a membership service, and Universal for theme park attractions.

So how does Nintendo go about choosing partners anyway? President Satoru Iwata shared a lengthy explanation, which you can find below. Iwata also touches more on how the Universal deal came together.

More: Satoru Iwata, top

Iwata on Nintendo’s monetization approach to smart device games, still working on Mii app

Posted on 8 years ago by Brian(@NE_Brian) in Mobile, News | 0 comments

One topic stemming from the Q&A portion of Nintendo’s latest financial results briefing concerns how the company will monetize its smart phone games. President Satoru Iwata offered some insight last week, and while he didn’t provide any specifics, he did discuss what the strategy is moving forward.

Iwata indicated that Nintendo is looking at the key term “wide and small” as opposed to “narrow and large”. He explained that the strategy is how to obtain “a small amount of money from a wide range of consumers.”

In his response, Iwata also mentioned that Nintendo is still working on its smart device app using Mii characters that has long been teased.

Read up on Iwata’s full comments below.

More: Satoru Iwata, top

Iwata on generating “Nintendo-like profits”, smart device business, preparing initiatives/changes for dedicated games business

Posted on 8 years ago by Brian(@NE_Brian) in General Nintendo, Mobile, News | 1 Comment

Returning to “Nintendo-like profits” is something that often tends to be discussed at the Big N’s financial results briefings. The general thought is that by reaching that mark, Nintendo would be bringing in an operating income of over 100 billion yen.

One investor asked about reaching “Nintendo-like profits” during the Q&A portion of the company’s financial results meeting last week after it was announced that Nintendo’s operating income target for this fiscal year is 50 billion yen. Check out what president Satoru Iwata had to say below. In addition to discussing “Nintendo-like profits”, Iwata also commented on what’s in store for the smart device business, and teased preparing initiatives/changes for the dedicated games business “to make changes to some of the elements that are currently not working so well.”

Firstly, we base our thinking regarding profits for the next fiscal year on generating those that can be seen as typical of Nintendo, just as you mentioned. As investors should determine “Nintendo-like profits,” I believe it is inappropriate for me to explain in public what level of profit this should be. However, many assess that generating an annual operating income of 100 billion yen can be considered a “Nintendo-like profit structure.” As such assessments have been made, we will structure our plans for the next fiscal year to reach such a level. For the fiscal year that just ended in March 2015, we positioned it to be the year to balance revenue and expenses, and we managed to accomplish this. We set our financial forecasts taking into consideration the steps we should take this fiscal year if we are to aim for “Nintendo-like profits” in the next fiscal year.

More: Satoru Iwata, top

A few more Iwata comments about Nintendo and Universal’s partnership for theme park attractions

Posted on 8 years ago by Brian(@NE_Brian) in General Nintendo, News | 11 Comments

Finally, please let me introduce you to one of our new efforts to maximize the value of the Nintendo IP.

Nintendo and Universal Parks & Resorts, which manages the “Universal Studios” theme parks, have reached a basic agreement about deployment of theme park attractions using Nintendo IP.

Based on this agreement, the two companies will jointly create attractive experiences by using the characters and the worlds of Nintendo games that people cannot enjoy anywhere else.

We will announce the details, including the specific period, which IP and how it will be used, at which park and the scale of the attractions, at some later date. However, today I just wanted to confirm with you that this sort of endeavor to actively use Nintendo IP has been progressing.

More: Satoru Iwata, top

Iwata on maximizing Nintendo’s IP, mobile plans

Posted on 8 years ago by Brian(@NE_Brian) in Mobile, News | 2 Comments

And now, I would like to discuss our future business developments.

Right now, the game business is undergoing significant change. The spread of the Internet and social media has dramatically changed the lifestyles of people all over the world, and Nintendo is adjusting its strategic endeavors in line with the new market dynamics.

For one thing, in order to maximize the value of Nintendo IP, we are working to leverage opportunities that go beyond a traditional focus on dedicated video game systems. As you know, amiibo is one such effort. Also, we made the announcement that we will take advantage of smart devices. As smart devices are increasing in significance as the dominant window through which consumers connect with one another and with society, it is natural for us to leverage smart devices to communicate directly with our consumers.

In addition, to facilitate the ability for consumers to be closely and continuously connected with Nintendo IP, Nintendo will also deploy Nintendo IP on games for smart devices.

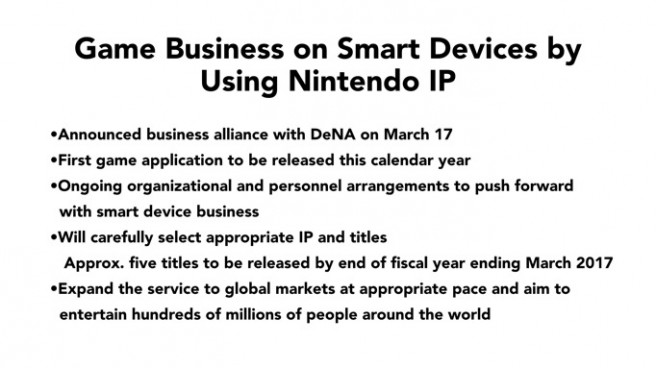

Regarding this subject, we announced our business alliance with DeNA on March 17. Each of our companies offers unique strengths, and we are confident that when combined, the synergies will enable us to compete strongly in the smart device space.

We will start the service for the first game application by the end of this calendar year. Internally at Nintendo, we have executed several organizational and personnel changes in order to properly operate the smart device business, and we will make further changes before the first release.

As we confirmed on March 17, all of our IP can be considered for a smart device game. On the other hand, since the game business on smart devices is already severely competitive, even with highly popular IP, the odds of success are quite low if consumers cannot appreciate the quality of a game. Also, if we were simply to port software that already has a track record on a dedicated game system, it would not match the play styles of smart devices, and the appropriate business models are different between the two, so we would not anticipate a great result. If we did not aim to achieve a significant result, it would be meaningless for us to do it at all. Accordingly, we are going to carefully select appropriate IP and titles for our smart device deployment.

Regarding the number of the titles, you may want to know that we will release approximately five titles by the end of the next fiscal year, which is the end of March 2017. You may think it is a small number, but when we aim to make each title a hit, and because we want to thoroughly operate every one of them for a significant amount of time after their releases, this is not a small number at all and should demonstrate our serious commitment to the smart device business.

We will strive to expand this business into global markets at a steady pace so that eventually we will entertain hundreds of millions of people all around the world. We are aiming to make this one of the pillars of Nintendo’s revenue structure.

More: Satoru Iwata, top

Iwata on Nintendo’s download sales

Posted on 8 years ago by Brian(@NE_Brian) in General Nintendo, News | 3 Comments

These graphs show the download sales transitions in the recent three fiscal years. In the just-ended financial year, following on from the third quarter, the fourth-quarter download sales grew dramatically and the total download sales for the full fiscal year reached 31.3 billion yen. The digital download sales increase of about 30 percent compared to the previous fiscal year should be mainly attributable to such facts as the sales of the digital versions of both the Nintendo 3DS and Wii U software increasing, especially in the overseas markets.

More: sales, Satoru Iwata, top

Iwata’s full comments on amiibo sales, shortages

Posted on 8 years ago by Brian(@NE_Brian) in General Nintendo, News | 0 comments

We launched a new product category – amiibo – simultaneously with “Super Smash Bros for Wii U,” and the end of the subject fiscal term marked a total shipment of approximately 10.5 million units worldwide. As we had shipped approximately 5.7 million units by the end of calendar year 2014, it is safe to say that we achieved very strong growth even in the period immediately after the year-end sales season was over. Our assessment is that people purchase additional amiibo figures without any seasonal bias, as they are relatively more affordable than video game titles.

Our consumers have been inconvenienced by stock shortages on some of the figures in our amiibo lineup. We have increased production for amiibo figures that have sold out very quickly after launch, that are indispensable to play a certain game and for which we have received strong demand from retailers and consumers. However, we are very sorry that we can?t promise at what point we will likely be able to resolve the current situation because figures such as these require a considerable amount of time to produce, store shelf space is limited and it is difficult to precisely predict the exact amount of overall demand.

On the other hand, the number of software titles compatible with amiibo is increasing and consumers’ recognition and understanding for amiibo has improved significantly compared to the launch period, so we believe that we can predict further sales growth.

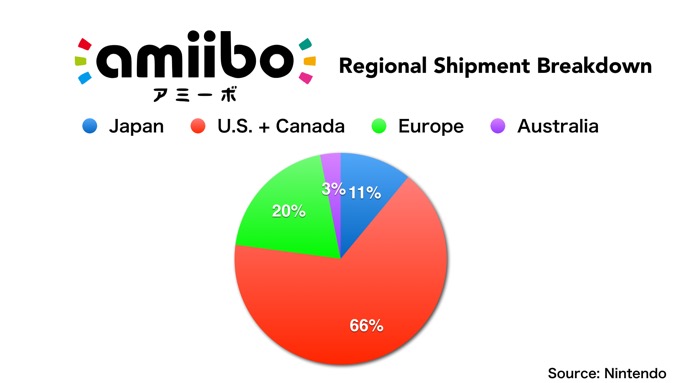

This pie graph shows the most recent regional shipment breakdown of amiibo. The U.S. and Canada, shown in red in the graph, have an overwhelmingly large 66 percent share, showing a tremendous presence overall.

In addition to figure offerings in the amiibo lineup this year, we are planning to release Yarn Yoshi amiibo and card-type amiibo. The first software title that is compatible with these amiibo cards is “Animal Crossing: Happy Home Designer,” which for Nintendo 3DS. Simultaneously, we will also launch the “Nintendo 3DS NFC Reader/Writer” so that not only the owners of New Nintendo 3DS, which is equipped with NFC functionality, but also the owners of the original Nintendo 3DS systems can play with amiibo. The NFC Reader/Writer enables consumers to play with amiibo on the original Nintendo 3DS systems, and we believe we can expect further growth in amiibo sales with this significant increase in the number of compatible hardware systems.

More: Amiibo, Satoru Iwata, top

Iwata on 3DS software, evergreen sales, more

Posted on 8 years ago by Brian(@NE_Brian) in 3DS, News | 0 comments

In the video game platform business, although people tend to focus on the huge spike of sales immediately after a game release, looking back at the history of Nintendo’s handheld game systems, not only does hardware sell well with new titles, but our systems also tend to sell well paired with big titles that have become evergreen.

This tendency is strongest in the overseas markets, and we will aim to expand our hardware by promoting new titles as well as retaining the energy of our abundant evergreen titles (which are not new on the market but maintain consistent sales.)

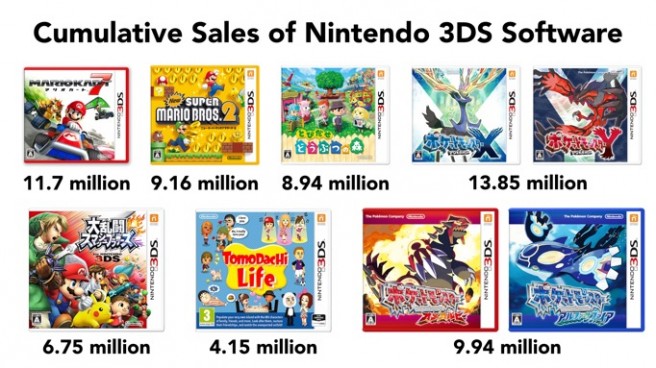

These are the cumulative sales figures of some of the Nintendo 3DS software sold so far. Although “Mario Kart 7” was released in 2011, “New Super Mario Bros. 2” and “Animal Crossing: New Leaf” were in 2012 and “Pokémon X” and “Pokémon Y” were released in 2013, each of these titles sold more than 1 million units in the subject fiscal year. In the overseas markets especially, many titles tend to become evergreen and sell consistently even long after their releases.

“Super Smash Bros. for Nintendo 3DS” was released in fall last year and sold 6.75 million copies by the end of the subject fiscal year. “Tomodachi Life” was released in Japan in November 2013 and in the subject fiscal year overseas, and it sold particularly well in Europe with the global cumulative shipment reaching 4.15 million units. Also, from their release in November last year to the end of the subject fiscal term, 9.94 million units of “Pokémon Omega Ruby” and “Pokémon Alpha Sapphire” were shipped. While on one hand, we will keep these titles evergreen and on another we will add new quality software, we aim to further expand the sales of Nintendo 3DS hardware by increasing its broad software lineup.

In addition, as I mentioned in my presentation for the last Financial Results Briefing, we are working on further promoting multiplayer gameplay using the local communication function of Nintendo 3DS in the overseas markets as well. This shall play a major role for franchises such as “Mario Kart,” “Animal Crossing,” “Super Smash Bros.,” “Pokémon,” “Monster Hunter” and for the “YO-KAI WATCH” game, which will be released in overseas markets in the future.

More: sales, Satoru Iwata, top

Iwata on 3DS hardware sales, planning titles that can appeal to women

Posted on 8 years ago by Brian(@NE_Brian) in 3DS, News | 9 Comments

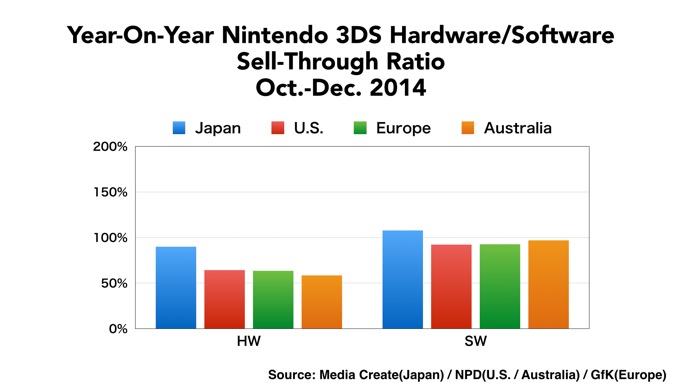

This is the graph displayed in the last Financial Results Briefing, which shows the percentage of change found in the sell-through data of Nintendo 3DS hardware and software in each market for the third quarter of this fiscal year compared to the corresponding term of the previous year.

As you can see, except for Japan, where New Nintendo 3DS contributed to the full quarter, the hardware sales fell far short of the previous year in the U.S. and Europe where the new models were not available during the third quarter and in Australia, where they were launched in late November.

In the fourth quarter, you can see the launch of New Nintendo 3DS in the overseas markets boosted the sales of both hardware and software from one year prior and brought momentum to the platform once again.

On the other hand, the Japanese market was in between big titles and this resulted in a different outcome after having enjoyed five double-million sellers in the latter six months of the year 2014.

In the Japanese market, the cumulative sales of Nintendo 3DS hardware since its launch are about to reach 19 million units. Regarding the Nintendo 3DS software market, the situation remains promising not only because there have been numerous major-hit titles released since the latter half of last year, but also because we have high hopes for the many titles that are planned to be released this year by both Nintendo and other game software developers. On the other hand, regarding the Nintendo 3DS hardware, four years since its release, we are seeing a certain level of positive results by the release of New Nintendo 3DS, but we still have not been able to break free from the period beyond the popularization of the Nintendo 3DS in which the performance leveled off. I believe that the key to revitalizing the Nintendo 3DS business in Japan is by intensifying its appeal to even more generations of female consumers.

This year, we are planning to release titles that offer high potential to appeal to female consumers, and we would like to further strengthen our approach to reach a female audience covering wider generations.

Meanwhile, in the overseas markets, the Nintendo 3DS hardware has not spread to a level where it has reached its market potential. In other words, there is plenty of room for growth.

Since the release of New Nintendo 3DS in February this year, especially for the large-screened New Nintendo 3DS XL, stock in stores has continued to run low in the U.S. and Europe, which of course is a sign that the game platform has momentum.