Nintendo stock prices drop following financial results, the company’s biggest dip since 2019

While the Switch’s sales have certainly been impressive (the system reaching over 89 million units sold), the company’s stock prices have dipped considerably following their financial results yesterday. Friday morning in Japan, Nintendo Co. LTD fell 8.8% in the market, its biggest dip since February 2019.

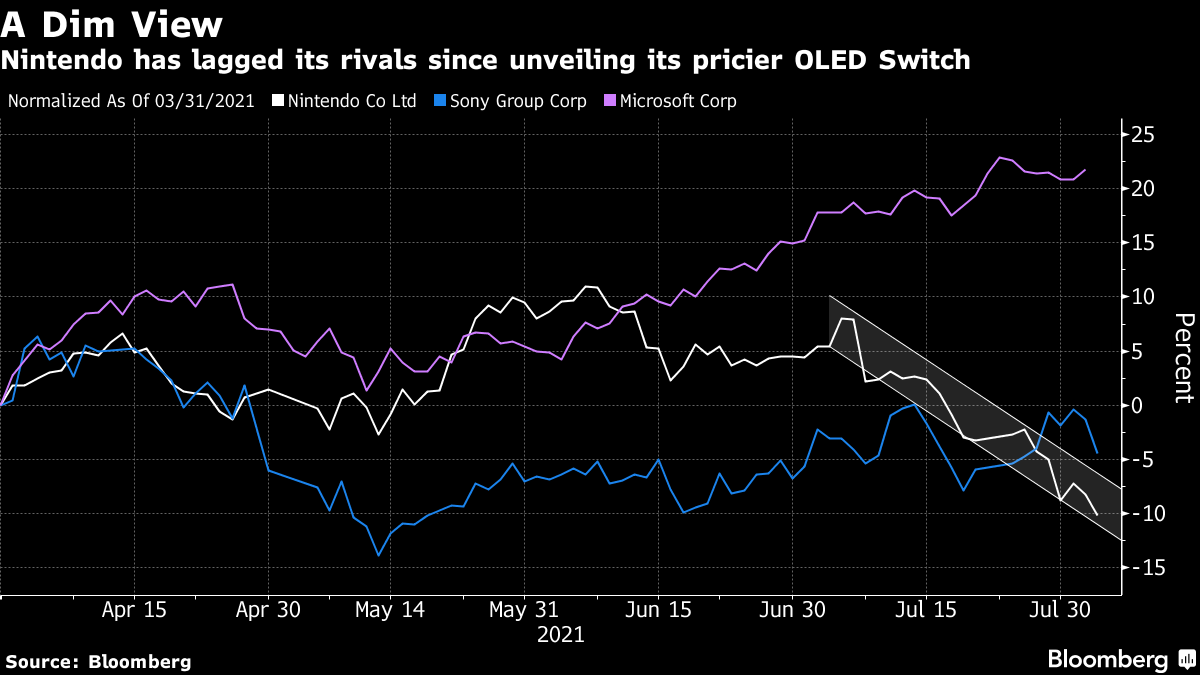

It seems Nintendo’s quarterly profit did not reach its estimates and investors are beginning to pull out; possibly due to worries that the handheld console market has hit its peak as the pandemic lessens in parts of the globe. Additionally, the new OLED Switch model has some investors questioning Nintendo as their sales slowed since its announcement and profits for Sony and Microsoft have increased (seen in the graph from Bloomberg below).

Whatever the reason for this stock dip (it is also most likely be affected by the semi-conductor shortage plaguing the electronics industry), it seems Nintendo is preparing for the dip by buying back shares for investors. This may help them gain back some of the loss and time will show what effect the OLED model’s release will have as well.