Iwata: “We haven’t been targeting children enough”, “thinking on how to make the company stand up again”

Posted on 12 years ago by Brian(@NE_Brian) in General Nintendo, News, Wii U | 21 Comments

Update: We’re hearing mixed reports about what Iwata actually said (or at least, the way in which it was phrased). Other potential translations: “Our approach to targeting children has been inadequate”, “Targeting children isn’t enough”. At this point, a consensus on Iwata’s comment hasn’t been reached.

Original: Another small comment coming from Satoru Iwata has emerged from Nintendo’s conference held in Osaka earlier today. It’s short and sweet: “We haven’t been targeting children enough,” he said.

Asahi Digital reported the quote, but it seems Iwata didn’t share anything extra about the kids demographic. However, the site does also include a separate remark in which Iwata said he’s “thinking on how to make the company stand up again”.

More: Satoru Iwata, top

Iwata says “Wii U isn’t in good shape”, more price cuts unlikely, will talk about smart devices at investor conference, more

Posted on 12 years ago by Brian(@NE_Brian) in General Nintendo, News, Podcast Stories, Wii U | 17 Comments

Nintendo president Satoru Iwata commented on a few topics ahead of the company’s investor briefing set to take place later today.

Of Nintendo’s buyback initiative, Iwata said that Hiroshi Yamauchi’s heirs will have to pay inheritance taxes and may need to sell shares. He also remarked:

“That won’t merit shareholders, that’s why we decided on the buyback. But that’s not all the reason. We’ve been rewarding our shareholders mainly through high dividends, but we cannot generate as much profit as we used to make.”

More: Satoru Iwata, top

Satoru Iwata will take a 50% pay cut

Posted on 12 years ago by Brian(@NE_Brian) in General Nintendo, News, Podcast Stories | 11 Comments

Back in July 2011, Nintendo president Satoru Iwata announced that he would be taking a 50 percent pay cut following poor 3DS sales. With the Wii U now facing a similar situation, Iwata is making a similar move.

Iwata will once again take a 50 percent pay cut, it’s been confirmed as part of Nintendo’s most recent financial results. Japanese publication Nikkei reports that his salary will be reduced from the period of February until June.

Nintendo’s two other representative directors, Genyo Takeda and Shigeru Miyamoto, will be taking a 30 percent cut as well. All other board directors, including Tatsumi Kimishima, Kaoru Takemura, Shigeyuki Takahashi, Satoshi Yamato, Susumu Tanaka, Shinya Takahashi, and Hirokazu Shinshi, will take a 20 percent reduction.

According to Iwata, Nintendo will evaluate future salaries based on the business environment at that time.

More: Satoru Iwata, top

Iwata: “The spread of smart devices does not spell the end of game consoles”

Posted on 12 years ago by Brian(@NE_Brian) in General Nintendo, News | 13 Comments

Nintendo is facing some tough times at the moment. Wii U isn’t selling like the company had hoped, forecasts have been slashed, and its shares are falling.

In light of these circumstances, analysts and others will continue to say that Nintendo should put its IPs on smart devices. Nintendo, though, is sticking to its guns.

During a news conference last Friday, Nintendo president Satoru Iwata reaffirmed the hardware manufacturer’s commitment to consoles, and indicated that we won’t be seeing Mario on smartphones anytime soon.

“The spread of smart devices does not spell the end of game consoles. It’s not that simple. It doesn’t mean that we should put Mario on smartphones.”

Iwata added that Nintendo must determine how to best use smartphones so that consumers become aware of its games.

More: Mario, Satoru Iwata, top

Iwata says the way people use their time, lifestyles, who they are have changed; Nintendo must not stay in one place

Posted on 12 years ago by Brian(@NE_Brian) in General Nintendo, News | 22 Comments

A few more comments from Satoru Iwata’s news conference held in Japan earlier today have come in.

As reported by The Wall Street Journal, the Nintendo president said:

“The way people use their time, their lifestyles, who they are have changed. If we stay in one place, we will become outdated.”

Iwata also acknowledged that Nintendo misread the markets and hadn’t issued “the appropriate instructions.” He understands that the company must change and “propose something that surprises our customers.”

More: Satoru Iwata, top

David Jaffe weighs in on Nintendo’s latest financial news, says Iwata should stick around

Posted on 12 years ago by Brian(@NE_Brian) in General Nintendo, News | 14 Comments

David Jaffe has been known for having some strong opinions of Nintendo, such as when he suggested that the company should be sold to Disney. Earlier today, Jaffe published a copious amount of tweets surrounding Nintendo’s latest financial news and commented on those calling for Satoru Iwata’s resignation. Head past the break for a full roundup of Jaffe’s tweets.

More: David Jaffe, Satoru Iwata

Iwata says Nintendo is “thinking about a new business structure”

Posted on 12 years ago by Brian(@NE_Brian) in General Nintendo, News, Podcast Stories | 14 Comments

During a press conference held earlier today in Osaka, Japan, Nintendo president Satoru Iwata said that the company is “thinking about a new business structure.”

Iwata’s comments seemed to come in response to the rise of the mobile/tablet space. In light of the expansion of smart devices, Iwata mentioned that Nintendo is “naturally studying how smart devices can be used to grow the game-player business.”

His comments in full:

“We cannot continue a business without winning. We must take a skeptical approach whether we can still simply make game players, offer them in the same way as in the past for 20,000 yen or 30,000 yen, and sell titles for a couple of thousand yen each.

“We are thinking about a new business structure. Given the expansion of smart devices, we are naturally studying how smart devices can be used to grow the game-player business. It’s not as simple as enabling Mario to move on a smartphone.”

More: Satoru Iwata, top

Satoru Iwata not resigning as president of Nintendo

Posted on 12 years ago by Brian(@NE_Brian) in 3DS, General Nintendo, News, Podcast Stories, Wii U | 16 Comments

Despite significant cuts made to Wii U and 3DS forecasts, Nintendo president Satoru Iwata won’t be resigning from his position, according to a report from Nikkei. The Japanese outlet states that Iwata has pledged to stay in office.

Iwata did take responsibility for the company’s disappointing business performance and apologized to shareholders today. He also mentioned that Nintendo must first restore momentum as soon as possible, and he will remain as president to see this through.

Things should get even more interesting come January 30, when Nintendo’s official financial results come in.

More: Satoru Iwata, top

Satoru Iwata issues lengthy statement in response to Nintendo’s forecast changes

Posted on 12 years ago by Brian(@NE_Brian) in 3DS, General Nintendo, News, Podcast Stories, Wii U | 11 Comments

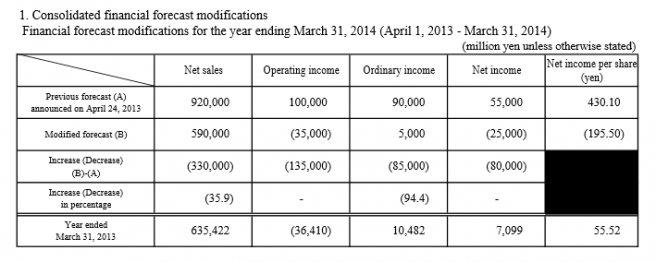

Earlier today, Nintendo announced some major forecast changes with regard to its upcoming financial results. President Satoru Iwata weighed in with a lengthy statement following today’s news, which you can find below.

We would like to explain the modifications of the full-year financial and dividend forecasts announced today.

We revised our full-year consolidated financial forecasts for the fiscal year ending March 31, 2014 that we announced at the beginning of the fiscal year by estimating new net sales of 590 billion yen against the initially projected net sales of 920 billion yen, new operating loss of 35 billion yen against the initially projected operating profit of 100 billion yen, new ordinary income of five billion yen against the initially projected ordinary income of 90 billion yen, and new net loss of 25 billion yen against the initially projected net income of 55 billion yen. Foreign currency assumptions for the end of the fiscal year have been revised from 90 yen to 100 yen per U.S. dollar and from 120 yen to 140 yen per euro.

Revised consolidated unit sales projections are, as outlined in “Notice of Full-Year Financial Forecast and Dividend Forecast Modifications,” 13.5 million units of the Nintendo 3DS hardware and 66.0 million units of the Nintendo 3DS software, 1.2 million units of the Wii hardware and 26.0 million units of the Wii software, and 2.8 million units of the Wii U hardware and 19.0 million units of the Wii U software. There are no modifications to our initial projections for the Nintendo DS hardware and software.

As for the estimated annual dividend, if the actual consolidated financial results are in line with our modified financial forecasts, there will be no annual dividend per share. However, on the basis of our dividends paid in the last two years, we have set a minimum of 100 yen for the year-end and annual dividend per share for this fiscal year.

As year-end sales constitute an extremely high proportion of the annual sales volume in the video game industry and the annual financial performance of a video game company rests heavily on its performance in the year-end sales season, we put in place various promotional activities in order to promote sales and expand our audience in the year-end sales season of the previous calendar year. However, it is now expected that our sales will fail to meet our previous forecast by a large margin.

Giving a detailed explanation on our sales performance in and leading up to the year-end sales season by platform, Nintendo 3DS continued to show strong sales in the Japanese market. The unit sales for Nintendo 3DS in the previous calendar year amounted to approximately 4.9 million units, falling short of our aim of five million units by a small margin. However, as I explained before, given that every gaming device from the year 2000 onwards apart from Nintendo DS and Nintendo 3DS did not reach sales of four million units even in their peak years, we can say that the sales figure for Nintendo 3DS in the last calendar year was indeed very high. However, outside Japan, while its market share increased as we continued to release compelling titles throughout the year, Nintendo 3DS did not reach our sales targets in the overseas markets, and we were ultimately unable to achieve our goal of providing a massive sales boost to Nintendo 3DS in the year-end sales season. Using the U.S. market as an example, Nintendo 3DS became the top-selling platform in the last calendar year, according to NPD, an independent market research company, with its cumulative sales exceeding 11.5 million units; however, the estimated annual sales of the Nintendo 3DS hardware remain significantly lower than our initial forecast at the beginning of the fiscal year. In Europe, while the individual markets showed different results, France was the only market in which we experienced relatively strong sales, and we failed to attain our initial sales levels by a large margin in other countries.

Wii U sales, on the other hand, showed some progress in the year-end sales season as we released various compelling titles from the summer onwards, launched hardware bundles at affordable price points and also performed a markdown of the hardware in the U.S. and European markets; however, they fell short of our targeted recovery by a large margin. In particular, sales in the U.S. and European markets in which we entered the year-end sales season with a hardware markdown were significantly lower than our original forecasts, with both hardware and software sales experiencing a huge gap from their targets. In addition, we did not assume at the beginning of the fiscal year that we would perform a markdown for the Wii U hardware in the U.S. and European markets. This was also one of the reasons for lower sales and profit estimates.

We therefore modified our unit sales estimates in accordance with our performance in the year-end sales season and after the turn of the year, and the drop in software sales had the largest negative effect on our profit forecasts.

Also, yen appreciation against the U.S. dollar and euro, which on one hand affects dollar-based and euro-based sales positively, also increases costs incurred in foreign currencies when they are converted to Japanese yen. While the yen remained very strong for a sustained period of time, Nintendo made a concerted effort to pay more of its manufacturing costs in U.S. dollars in order to minimize its impact. However, as the era of the exceedingly strong yen concluded, our domestic business, which had been progressing at a relatively strong pace, has seen an increase in manufacturing costs, while our overseas business, which is yet to reach its full potential, has not fully benefited from the weaker yen yet. In terms of our profitability in the current fiscal year, therefore, we were unable to sufficiently take advantage of the weaker yen.

As for advertising expenses, and research and development expense forecasts, we made revisions to increase them by eight billion yen and 15 billion yen respectively from their forecasts made at the beginning of this fiscal year. We expect advertising expenses to increase due to the effect of the expenses incurred in foreign currencies to be converted into Japanese yen by using weaker yen rates. The estimated increase of research and development expenses is based on reflecting our ongoing enhancement of the development structure, and new research and development activities. These increases contributed to lowered estimated profit forecasts.

We expect that we will post ordinary income despite the operating loss situation. This is because we now assume that the yen will be weaker than our original assumptions at the beginning of the fiscal year, and re-evaluation of assets and liabilities denominated in foreign currencies owned by Nintendo Co., Ltd. at the end of the fiscal year as well as foreign exchange gains at the time of cash receipts and conversions of foreign funds into yen, among other factors, are expected to exceed the projected operating loss.

On the other hand, we expect to post a net loss despite expecting ordinary income mainly because we need to reverse deferred tax assets in relation to the losses carried over from the previous fiscal years mainly in the United States, as we can no longer expect our financial performance to recover in the current fiscal year.

We will provide more information on our short-term as well as mid-term prospects at the Corporate Management Policy Briefing to be held on January 30, 2014, which will take place in Tokyo a day after we announce our financial results for the third quarter.

These are all of the explanations about modifications of our full-year financial and dividend forecasts.

More: Satoru Iwata

Nintendo announces heavy forecast cuts for Wii U and 3DS

Posted on 12 years ago by Brian(@NE_Brian) in 3DS, News, Podcast Stories, Wii U | 3 Comments

Nintendo’s latest financial results won’t be published until January 30, but the company did announce significant changes to its financial targets today.

Here’s a roundup of the pertinent information:

– Nintendo expected to sell 18 million units of 3DS between April 2013 and March 2014

– Now reduced to 13.5 million

– Software forecasts down from 80 million to 66 million

– Nintendo told investors it would sell 9 million Wii U units between April 2013 and March 2014

– Down to 2.8 million units

– Wii U software forecast down from 38 million to 19 million

– Nintendo was unable to boost 3DS hardware sales in the west significantly during the end-of-year holiday season

– Wii U sales were up during the holidays, but not enough for Nintendo to be able to hit their forecasts by the end of the fiscal year

– Expected net income of 55 billion yen changed to net loss of 25 billion yen

– Instead of posting an operating profit of 100 billion yen, the company expects to post an operating loss of 35 billion yen

– Nintendo president Satoru Iwata says the company will discuss its short-term and mid-term strategy at its next financial results meeting on January 30th